new mexico gross receipts tax return

Property includes real property. Receipts from selling livestock and the receipts of growers producers and trappers from selling live poultry unprocessed agricultural products for example a bale of hay a head of lettuce or an unroasted sack of green chili hides or pelts 7-9-18.

How To File And Pay Sales Tax In New Mexico Taxvalet

Combined Fuel Tax Distribution.

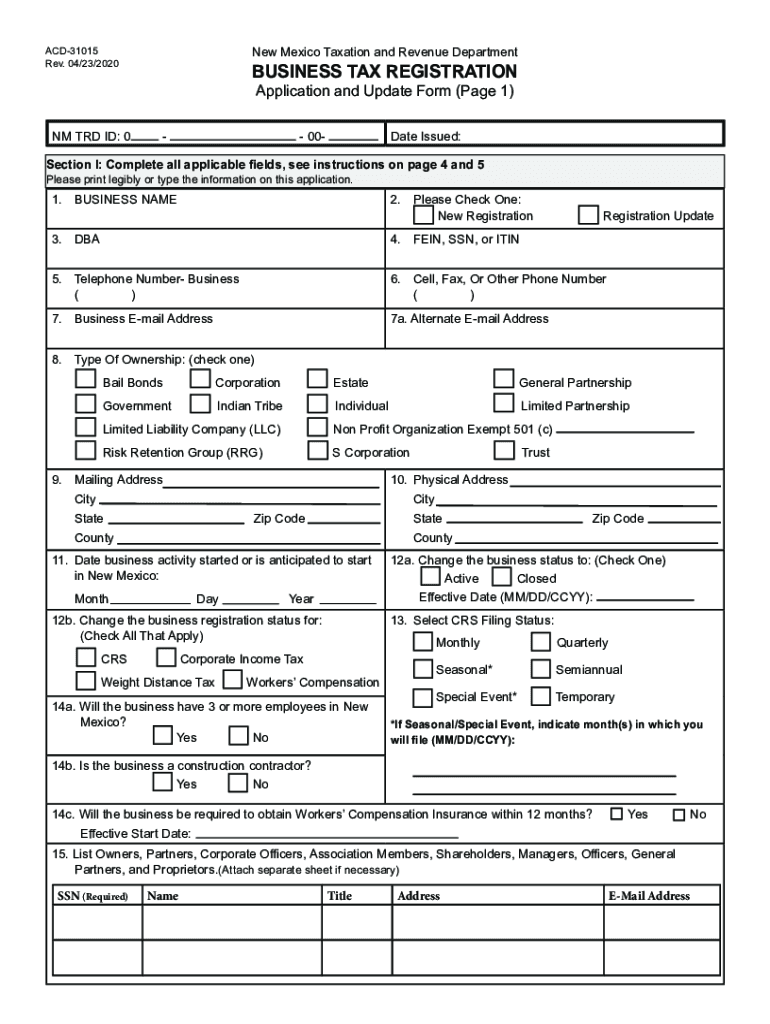

. NM Business Taxes. Generally a business collecting over 1000 in gross receipts tax each month will file monthly. We urge you to give it a try.

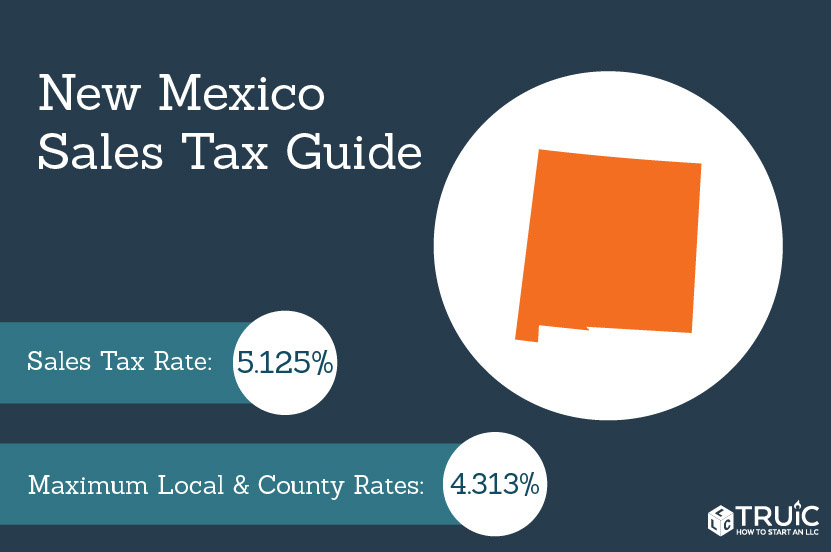

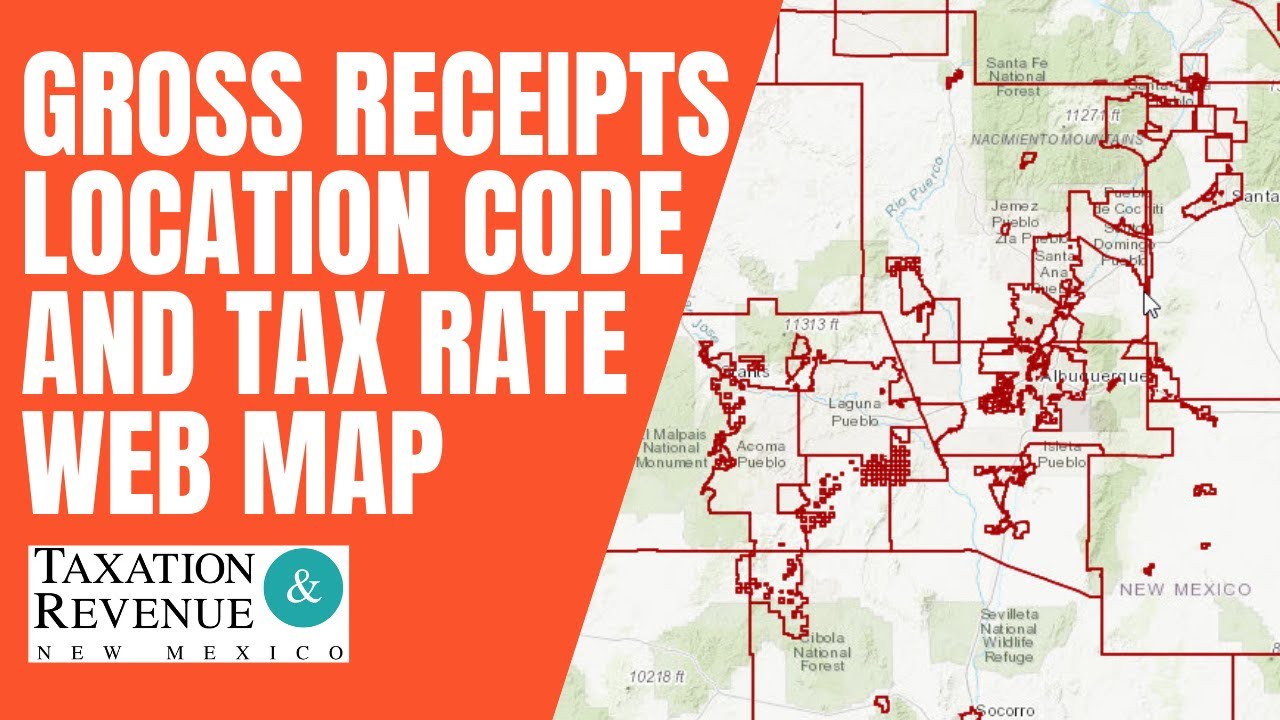

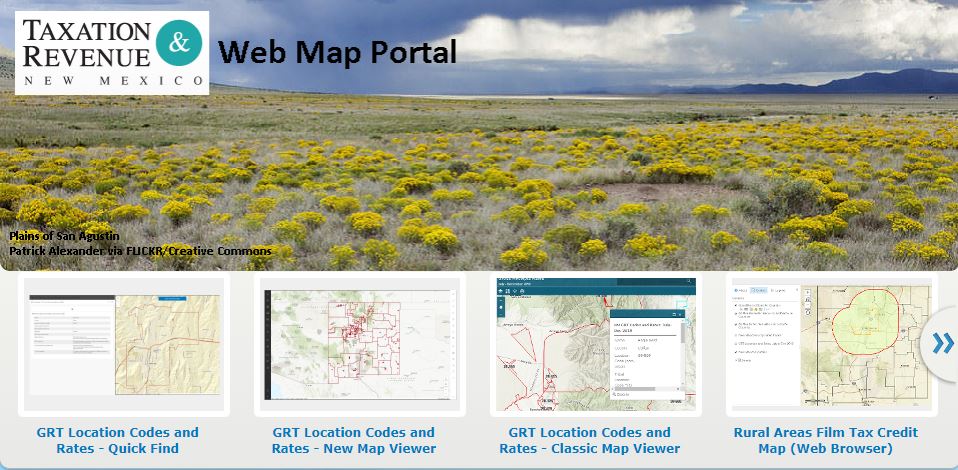

Anything over 5125 percent represents local option rates imposed by counties and municipalities. In general the gross receipts tax rate is origin-based determined by the business location of the seller or lessor not the location of the buyer or lessee. Gross Receipts Location Code and Tax Rate Map.

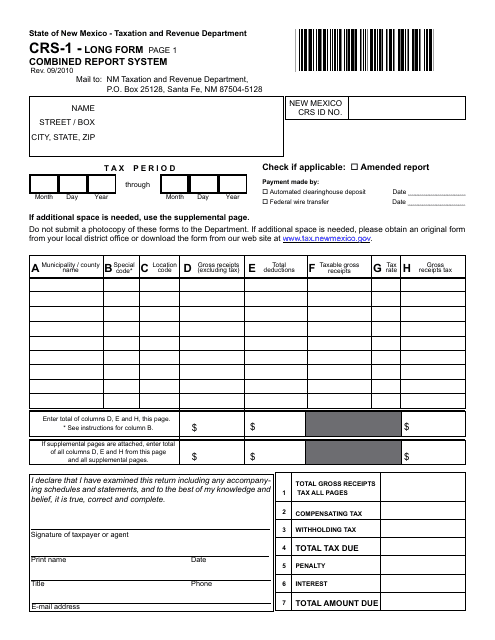

Gross Receipts tax rates are subject to change twice a year. Enter the total amount of gross receipts excluding tax here. The following receipts are exempt from the NM gross receipts tax sales tax.

Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports. Gross Receipts by Geographic Area and 6-digit NAICS Code. There is no cost for a gross receipts tax permit in New Mexico.

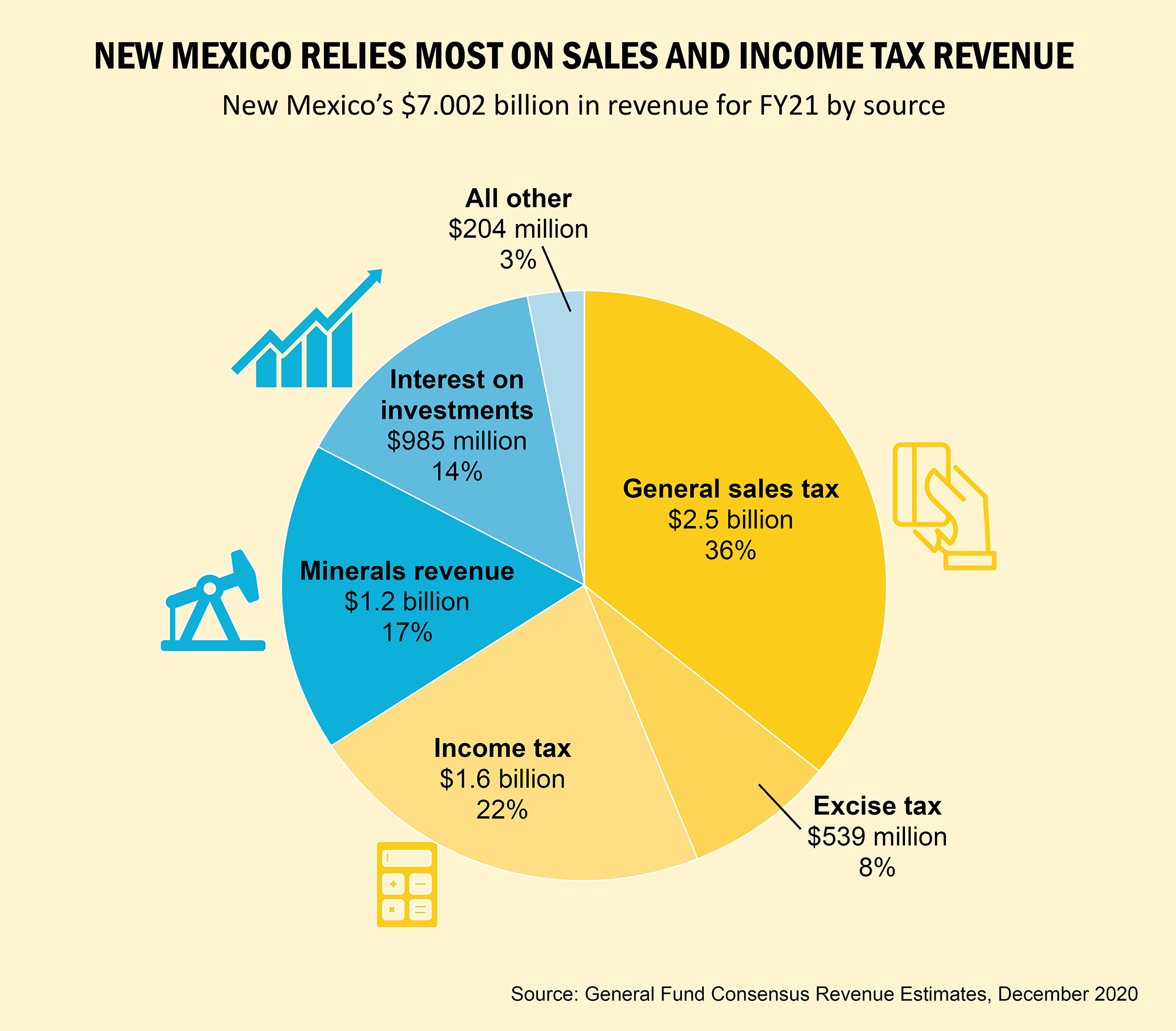

Calculation of 112 Increment for the. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the. Personal Income Tax Gross Receipts Tax also known as CRS Combined Reporting System.

TRD administers several tax programs all of which may be affected. 7875 on 112 sale price excise tax to come up with gross receipts tax due of 882. Corporate Income Franchise Tax.

As for payment E-pay is the quick and green way to. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes. On April 4 2019 New Mexico Gov.

GRT applies to the gross receipts of businesses or people who sell property perform services lease or license a property or franchise in New Mexico and sell certain services delivered outside New Mexico when the resulting product is initially used here. Collection and distribution data of the gross receipts tax are also provided in the Monthly Local Government Distribution or RP-500 reports. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that ranges from 0 to 9062 across the state with an average local tax of 2258 for a total of 7383 when combined with the state sales tax.

When are New Mexico gross receipts tax returns due. I received a letter that Im being audited for gross receipts tax. Fiscal Year RP-80 Reports.

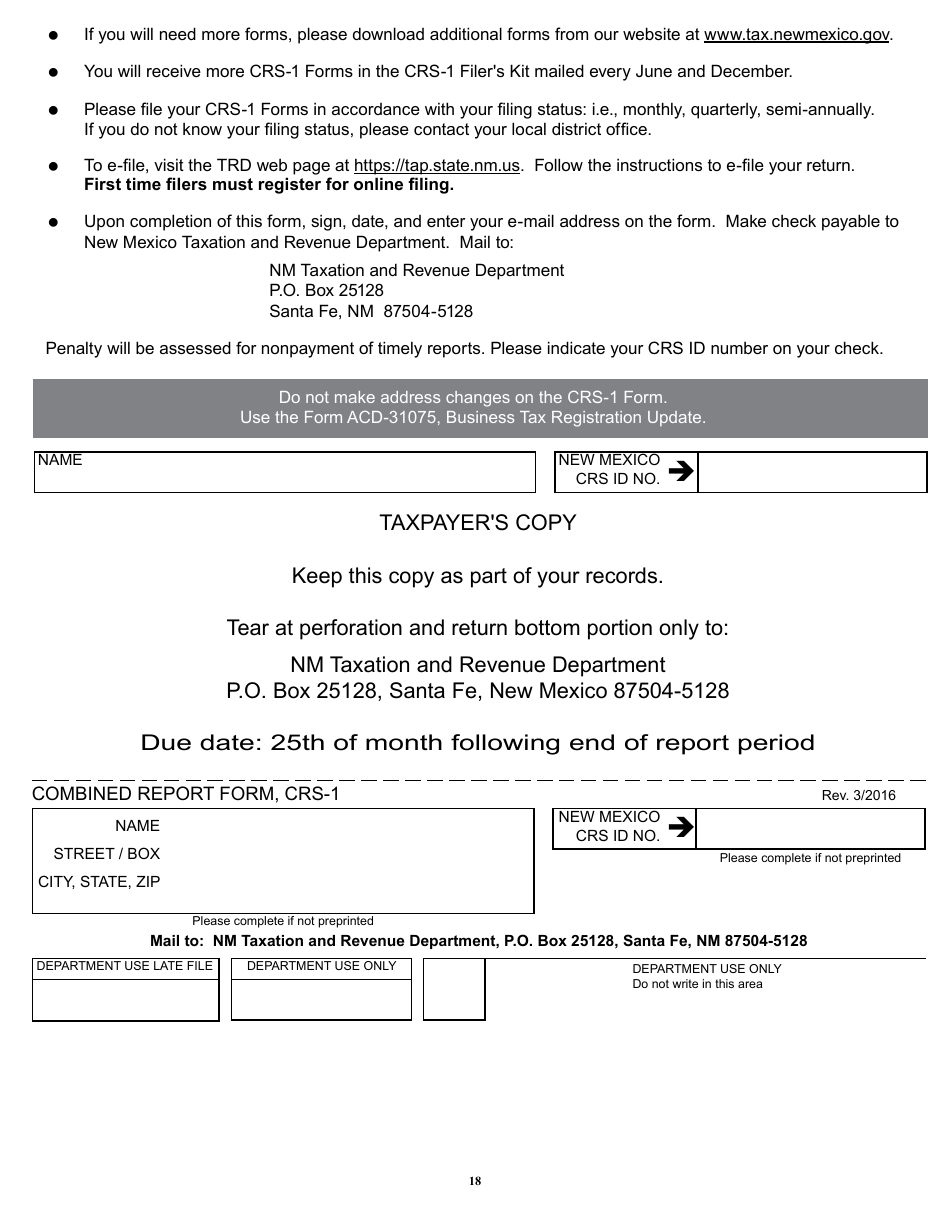

Each Form TRD-41413 is due on or before the 25th of the month following the end of the tax period being reported. BEnter the total amount of gross re- ceipts tax from all Schedule A pages. Jul 8 2020 Jobs the Economy Other Affected Services Tax and Rev.

The changes to the GRT came primarily in response to the US. Some transactions are tax exempt and some are deductible. The tax is imposed on the gross receipts of persons who.

AEnter the total amount of gross receipts tax due here. The gross receipts tax is a tax on persons engaged in business in New Mexico for the privilege of doing business in New Mexico. New Mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933.

They offer faster service than transactions via mail or in person. What are gross receipts. Michelle Lujan Grisham recently signed into law a bill that waives penalties and interest on late.

The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent. Economic Statistical Information. The Taxation and Revenue Department will determine a filing frequency based on the expected sales volume which will be monthly quarterly or semi-annually.

If Schedule A pages are attached enter total of columns D and I. Do I use the GRT rate for my business location. The same sale in the city of Santa Fe would result in a gross receipts tax due of 945 112 x 84375.

Gross Receipts by Geographic Area and NAICS Code. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. In Las Cruces it would result in a gross receipts tax due of 931 112 x 83125.

AS REPORTED ON THE ATTACHED TAX RETURN ON WHICH THE DEDUCTION WAS TAKEN New Mexico Taxation and Revenue Department Advanced Energy Gross Receipts Tax Deduction Report A Enter the Buyers NMBTIN Enter the location code. Filing online is fast efficient easy and user friendly. Tangible personal property including electricity and manufactured.

Whats this all about. What is exempt from NM. Isnt the New Mexico gross receipts tax the same as sales tax.

Do non-profits have to pay gross. Confidentiality of Tax Return Information. Tax deduction claimed as listed on the Type 10 NTTC.

Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things. Total Gross Receipts Tax. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

Sell property in New Mexico. Certain taxpayers are required to file the Form TRD-41413 electronically. Monthly Local Government Distribution Reports RP-500 Gross Receipts by Location.

Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports. SANTA FE New Mexico personal and corporate income tax returns for 2019 must be filed by July 15 to avoid penalties under a law enacted during the recent special legislative session. Supreme Court decision in South Dakota v.

First and last day of the report period mmddyyyy through mmddyyyy. For fiduciaries that file on a calendar-year basis the New Mexico FID-1 New Mexico Fiduciary Income Tax Return is due on or before April 15 with the payment of taxes due. GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return.

Gross Receipts by Geographic Area and NAICS Code. Gross Receipts by Geographic Area and NAICS Code. Frequently Asked Questions.

Electronic transactions are safe and secure. New Mexico Taxation and Revenue Department GOVERNMENTAL GROSS RECEIPTS TAX RETURN This report can be filed online at httpstapstatenmus I declare that I have examined this return including any accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete. Gross Receipts by Geographic Area and NAICS code.

Taxation and Revenue New Mexico.

64 Falcon 200 With Images Cars Cars Trucks Ford Falcon

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report New Mexico Templateroller

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

New Mexico Sales Tax Small Business Guide Truic

When I First Moved To New Mexico Last Year And Began The Legwork Of Setting Up My Own Business As An Independent Filing Taxes Business Workshop Web Development

Nm Lodgers Tax Report 2020 2022 Fill Out Tax Template Online Us Legal Forms

Gross Receipts Location Code And Tax Rate Map Governments

Gross Receipts Location Code And Tax Rate Map Governments

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

Revenue Windfall Could Prompt Tax Cut Talks Albuquerque Journal

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube