lincoln ne sales tax rate 2018

L Local Sales Tax Rate. The Nebraska state sales and use tax rate is 55 055.

One of a suite of free online.

. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling 175. Free Unlimited Searches Try Now. Income Tax Rate Indonesia.

This is the total of state county and city sales tax rates. The Lincoln County sales tax rate is. There is no applicable county tax or.

Lincoln NE Sales Tax Rate. Lincoln is located within Lancaster County. Nebraska City NE Sales Tax.

Ad Get Nebraska Tax Rate By Zip. Revenue Information Bulletin 18-017. Opry Mills Breakfast Restaurants.

Restaurants In Matthews Nc That Deliver. Troy MO 63379 Email Me. This includes the sales tax rates on the state county city and special levels.

NE Sales Tax Rate. Sales Tax Rate s c l sr. So whilst the Sales Tax Rate in.

Free Unlimited Searches Try Now. In 2015 voters approved a three-year quarter-cent sales tax that ended in September 2018. In Lincoln another 15 percent or one and a half cents is added for a city.

That money has been used to buy and install a new 911 radio system and build three new fire. McCook NE Sales Tax Rate. The Lincoln sales tax rate is.

Sr Special Sales Tax Rate. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Lincoln Ne Sales Tax Rate 2018.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. This is the total of state and county sales tax rates. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent.

The Nebraska state sales and use tax rate is 55 055. Society of lancaster co. Lincoln voters approved the 14-cent increase in April.

The Lincoln sales tax rate is 175. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate.

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. The average cumulative sales tax rate in Lincoln Nebraska is 688. Hours Monday - Friday 8 am.

The 2018 United States Supreme Court decision in South Dakota v. Ad Get Nebraska Tax Rate By Zip. Lancaster county 201415 201718 201819 201920 1 yr 5 yr tax rates for taxpayers rate rate rate rate change change inside lincoln city limits agric.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. The Nebraska state sales tax rate is currently.

Counties and cities can charge an. Groceries are exempt from the Nebraska sales tax. Lexington NE Sales Tax Rate.

The 2018 United States Supreme Court decision in. The County sales tax rate is 0. La Vista NE Sales Tax Rate.

The Nebraska sales tax rate is currently 55. Did South Dakota v. Lincoln NE Sales Tax Rate.

Nebraska has a 55 sales tax and Lincoln County collects an additional NA so the minimum sales tax rate in Lincoln County is 55 not including any city or special district taxes. 025 lower than the maximum sales tax in NE.

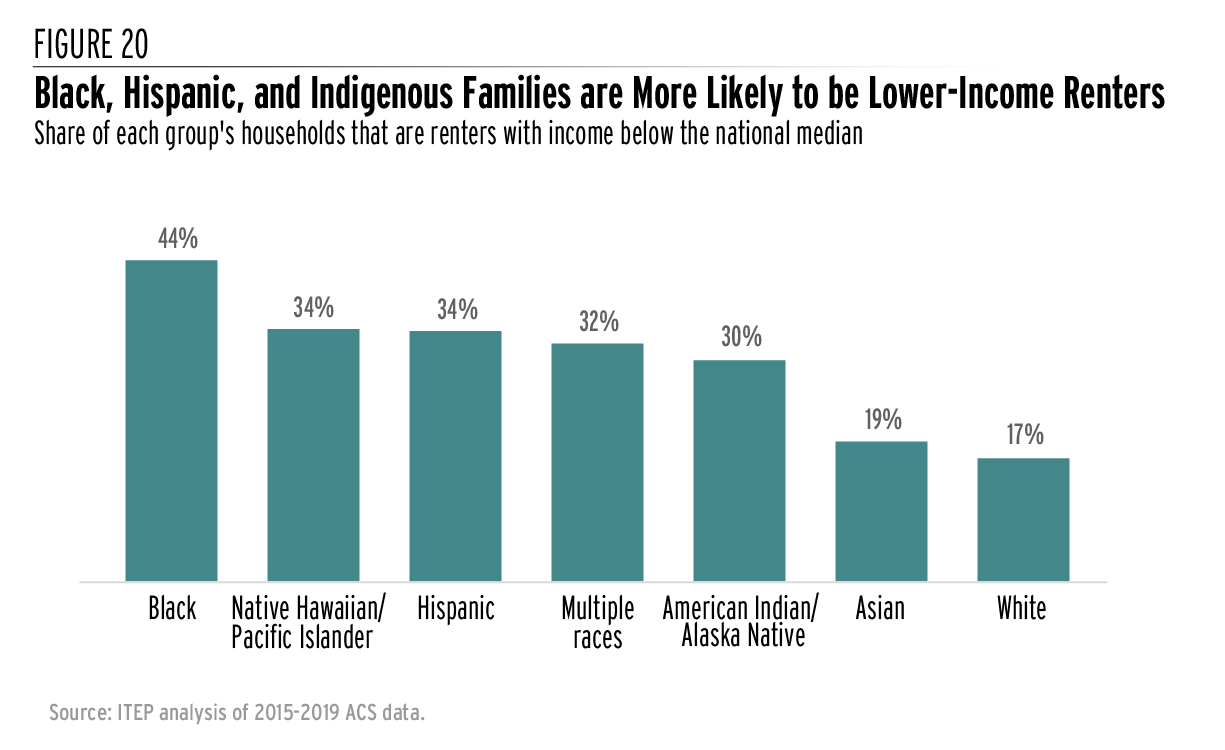

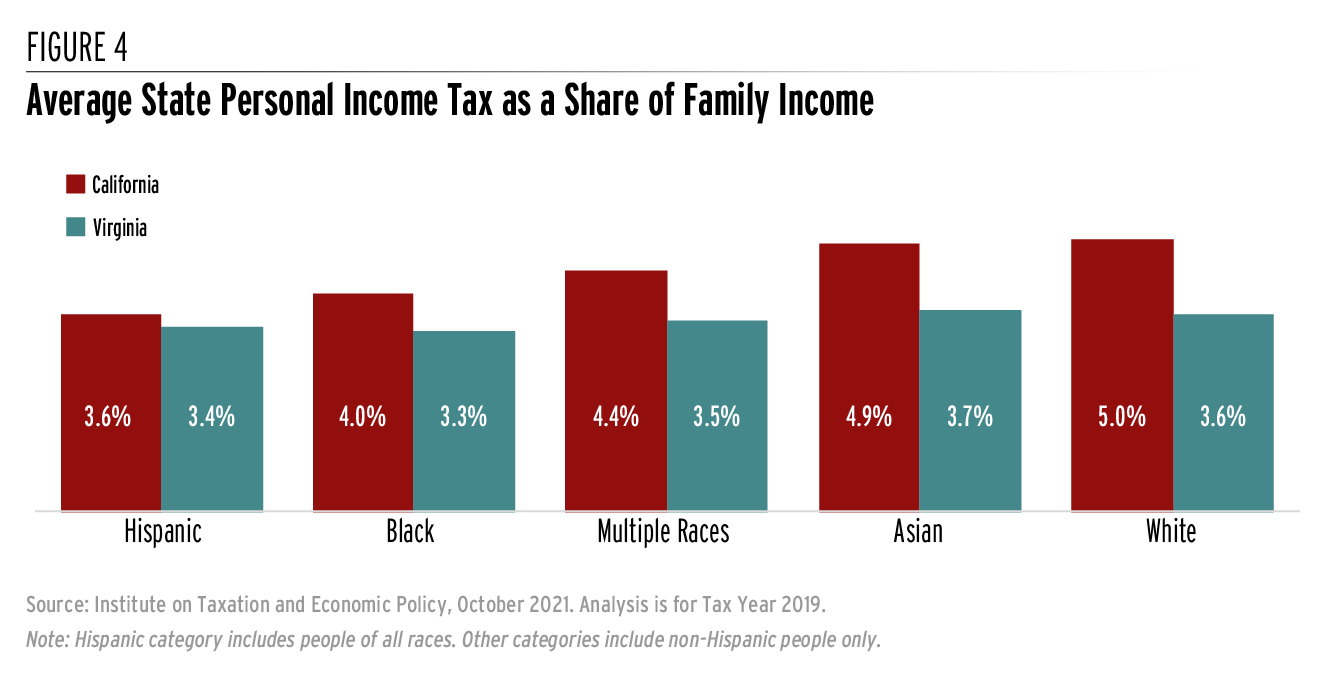

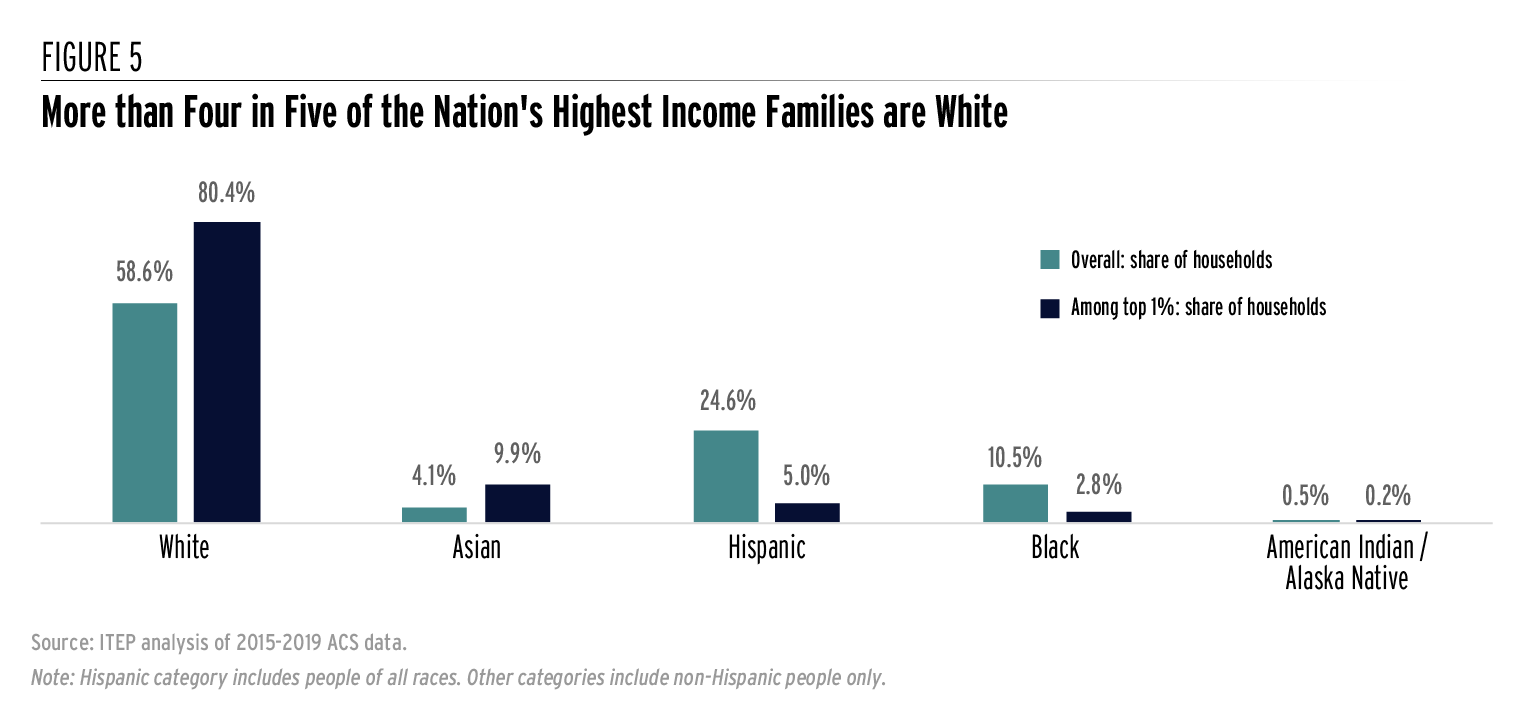

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

General Fund Receipts Nebraska Department Of Revenue

Gross Receipts Location Code And Tax Rate Map Governments

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Why Households Need 300 000 To Live A Middle Class Lifestyle

Colorado Property Tax Calculator Smartasset

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How To Register For A Sales Tax Permit Taxjar

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

General Fund Receipts Nebraska Department Of Revenue

Corporate Tax In The United States Wikiwand

California Sales Tax Rates By City County 2022

Why Households Need 300 000 To Live A Middle Class Lifestyle